International payroll services

Our experienced team can handle complex payroll in an international setting.

Let’s chat about your payroll needs

We value your privacy and we’ll only send you relevant information. For full details, check out our privacy policy

Payroll process

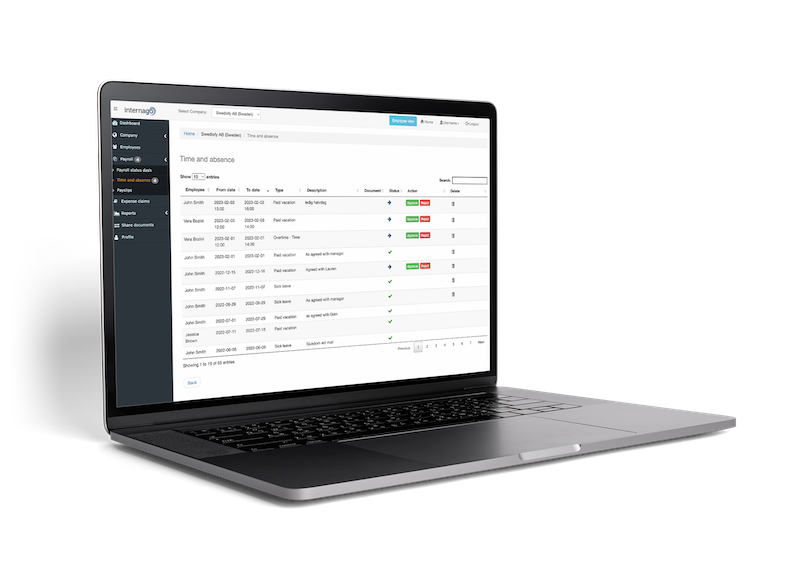

With the Internago web portal you get an easy to use system covering the full payroll cycle.

During this process, central HR can at any time, with a single sign-on, monitor the process, recieve employee data and get access to reports in multiple markets.

International payroll services

Payroll can be complex on foreign markets. Local rules and regulations apply.

You need to ensure that you have local employment contracts, and that you understand local taxes and social contributions. We are specialized in working with payroll on international markets. We ensure that your company is fully compliant with local regulations. Our payroll portal enables you to have full control and overview of your payroll process and staff.

Process oriented approach

Internago works with payroll using a process oriented approach.

We have over time developed our own process to optimize all the different steps in the payroll cycle for our customers. A key feature in our payroll process is to have one project manager, clearly defined steps in the payroll cycle along with a well established payroll calendar.

Technical integrations

We are convinced that technology adds considerable value to the payroll process.

Technical integrations with our customers’ systems will result in saving time while increasing quality. We strive to minimize manual processing and find ways for technology to replace repetitive and time consuming tasks in the payroll cycle. When we kick off a project, we always make an assessment of the customers’ current systems to find out where we could find integration possibilities.

Quality focus

Every payroll project is different and must be given full attention.

International payroll is often complex and needs to be thoroughly analysed and prepared by our experts. At Internago we focus on quality, not quantity. We enjoy complex payroll assignments, and we make sure that we always deliver quality for our customers regardless of the size of the headcount.

Local experts

Our experienced team has worked in various industries and with a wide range of challenges.

We can take care of the complex and time-consuming administrative tasks before, during and after you enter a new market.

Payroll

- Implementation and onboarding

- Payments

- Gross up calculations

- Tax filing

- Gross to net (GTN)

- Shadow payroll

- Bonus and RSU calculations

- Leaver calculations

- Simulations

Legal

- Employment contracts

- Foreign employer registration

- Tax and VAT registration and filing

- Incorporation

- B2B contacts

– Implementation and onboarding

– Payments

– Gross up calculations

– Tax filing

– Gross to net (GTN)

– Shadow payroll

– Bonus and RSU calculations

– Leaver calculations

– Simulations

– Employment contracts

– Foreign employer registration

– Tax and VAT registration and filing

– Incorporation

– B2B contacts

The implementation process went very smooth, and the fact that is was online made it easier and more transparent for us at the HQ to follow the progress, and we could update the necessary information for incorporation, bank and fiscal codes etc. in realtime.

Rickard Lundström

CFO, Rototilt Group AB

Internago has handled our international operations very professionally, from setup to continuous management.

Their service is professional yet personal, with a solid web portal for managing all documentation.

Max Friberg

Founder, Inex One

I recommend Internago to companies that want to develop their business and grow into new markets.

Fabio Frozzi

CEO, Co.Ma SPA

What's next?

Internago offers a wide range of services to support your international business. Our experts are available to answer your questions on our payroll services, to arrange a demo of our portal, and generally to guide you.